President Biden on Tuesday rolled out a plan he says will shore up Medicare for decades, and we’re all supposed to believe the spin: looming insolvency averted. But this proposal is really a huge tax increase paired with prescription-drug rationing that does nothing to reform the health entitlement, and the tax ratchet is only beginning.

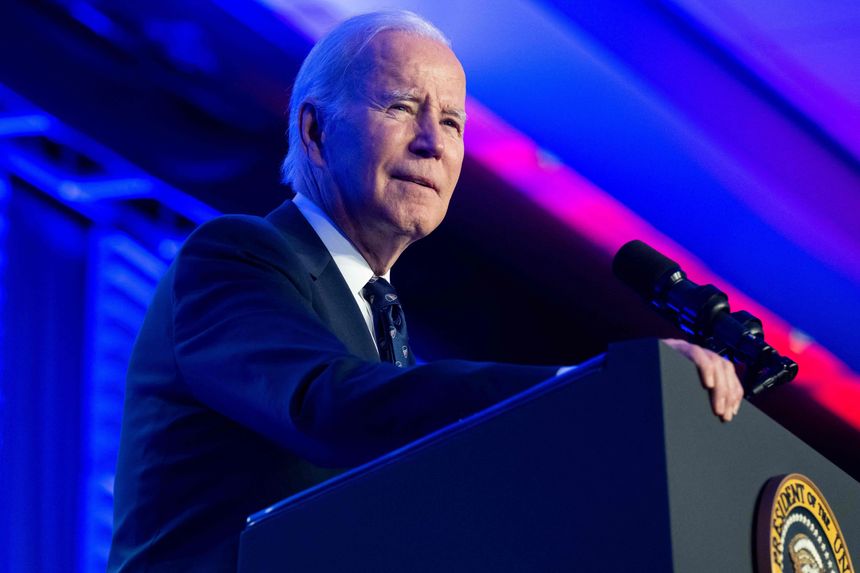

The White House in a fact sheet previewed a proposal for “extending Medicare solvency” in its budget outline for fiscal 2024, set for release Thursday. Mr. Biden says he’ll extend “the life of the Medicare Trust Fund by at least 25 years,” without “benefit cuts” while “lowering costs for Medicare beneficiaries.” The program’s hospital insurance trust fund is set to start coming up short in 2028.

This Medicare miracle will come mainly from raising taxes and diverting the money into what was supposed to be a self-financing trust fund. The Administration would extend the Affordable Care Act’s 3.8% surtax on investment income to business income. Pair that with jacking up the rate to 5%, but putatively only for those earning north of $400,000. The current net investment tax kicks in at $250,000 for married couples, so call the new bracket a surtax on the surtax.