The Federal Reserve on Wednesday approved its 10th interest rate increase in just a little over a year and dropped a tentative hint that the current tightening cycle is at an end.

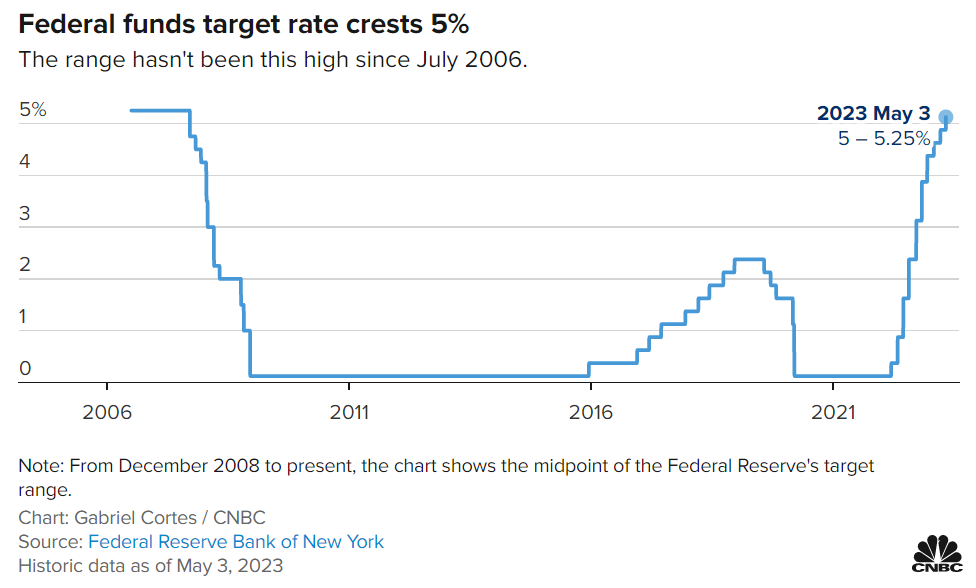

In a unanimous decision widely expected by markets, the central bank’s Federal Open Market Committee raised its benchmark borrowing rate by 0.25 percentage point. The rate sets what banks charge each other for overnight lending but feeds through to many consumer debt products such as mortgages, auto loans and credit cards.

The post-meeting statement offered only some clarity on a potential pause in rate hikes, and not by what it said but what it didn’t say. The document omitted a sentence present in the previous statement saying that “the Committee anticipates that some additional policy firming may be appropriate” for the Fed to achieve its 2% inflation goal.