The Thread

The Thread's AllSides media bias rating is Mixed. AllSides gives a source a Mixed rating when it has a system for aggregating content that is open and transparently designed to show multiple perspectives and the content comes from sources that are left, center and right.

The Thread displays multiple perspectives and data points on hot-button issues of the day in order to "empower our readers to form their own research-backed opinions." Weekly Questions include topics such as, "Should Minimum Wage be $15?" "Should Uber Drivers Be Employees?" and so on.

The Thread always highlights the common "thread" of agreement between both sides of policy debate. For example, a piece on the merits and feasibility of Universal Basic Income explores arguments on both sides, and notes the common thread is: "Both sides say that regardless of your race, creed, or financial position at birth, you should have the same opportunity for success as anyone else."

About The Thread

The creators of The Thread write that they are "frayed" from "sensational headlines, biased reporting, and an endless drone of opinions that either make you want to cry out in despair or punch someone. We call it, “living in the fray." The Thread was created "to be the first thread of change."

"We aim to be the go-to resource for factual and politically diverse commentary on some of the most important issues we face. We represent the independent thinkers and the politically exhausted. We believe that research and data empower us to face our most pressing challenges. That arming people with knowledge will help us to look beyond political silos and form our own opinions."

The Thread's mission is to "empower individuals to think independently. Inspire communities to speak collaboratively."

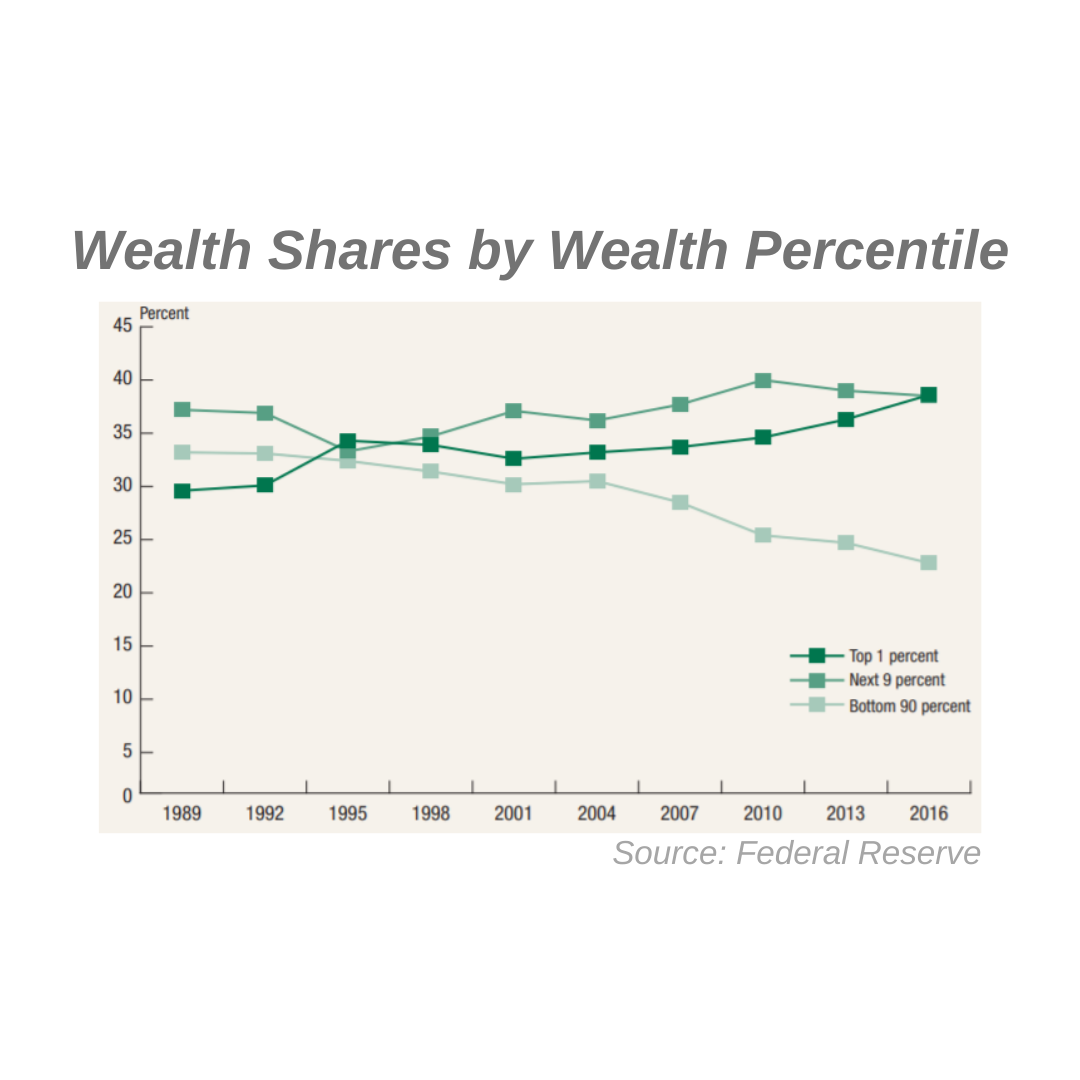

WHY IT MATTERS: According to the Federal Reserve, income and wealth inequality in the United States is on the rise. This fact has been highlighted by several 2020 presidential candidates, who believe that wealth is too highly concentrated at the top. One proposal to redistribute wealth from the top earners is a wealth tax (there are currently several versions of this tax being suggested). While most taxes hit a flow of money (like when you earn money via an income tax or when you buy a product via a sales tax), a wealth tax hits stagnant money, such as business assets, personal belongings, etc.

This article explores the pros and cons of the Wealth Tax -- which would tax the wealth of individuals whose net wealth totals $50 million or more. The proposal has become particularly newsworthy as 2020 presidential candidates have openly debated the policy with several billionaires, including Bill Gates and Mark Cuban.

THE COMMON THREAD: Both sides believe that the tax system should be equitable and promote growth.