The wealthiest Americans may be dodging as much as $163 billion in income taxes every year, according to the U.S. Department of the Treasury, and many leverage tax laws to do it legally, financial experts say.

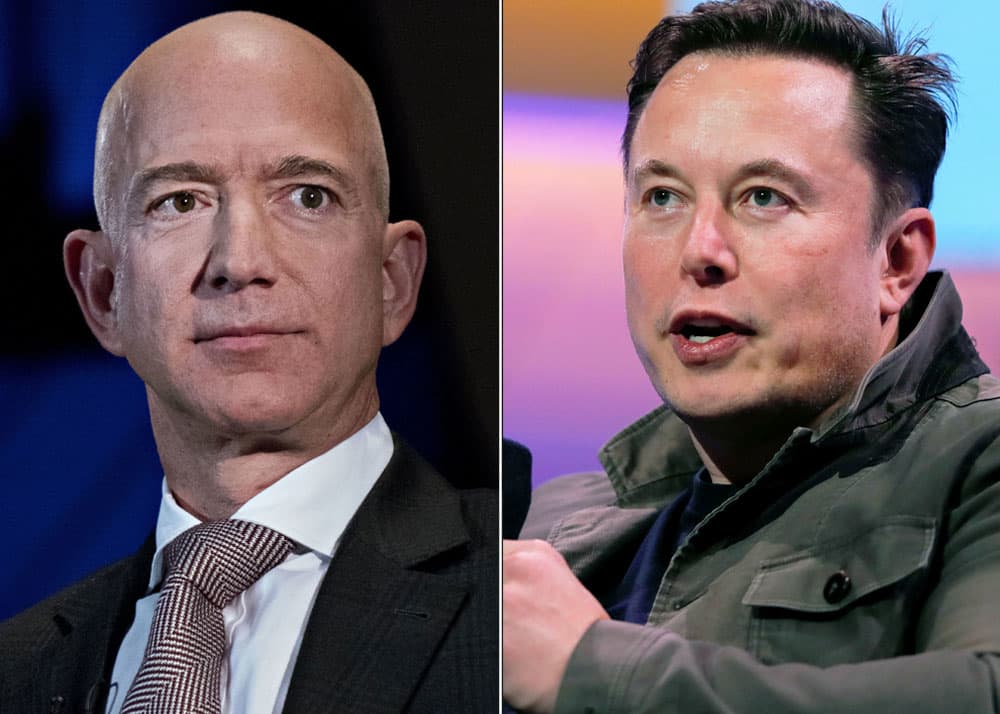

Although U.S. levies increase with income, the ultra-wealthy often finesse the tax code to reduce how much they owe. And some billionaires, such as Amazon founder Jeff Bezos and Tesla CEO Elon Musk, pay little to no taxes compared to their wealth, a ProPublica report found.

“As long as you’re adhering to the law, everything’s fair game,” said certified financial planner Sharif Muhammad, founder and CEO of Unlimited Financial Services in Somerset, New Jersey.

While most Americans earn money through labor, such as salaries and benefits, the super affluent may receive income from interest, dividends, capital gains or rent, from investments, known as capital income.

Everyday Americans typically cover taxes through their paychecks, though the 1% may not see income on their tax returns because they can delay selling investments or use losses to offset capital gains.

For example, an executive may receive stock-based compensation, and when it’s time to sell, they may sell other losing investments the same year to zero out their taxable growth, Muhammad said.